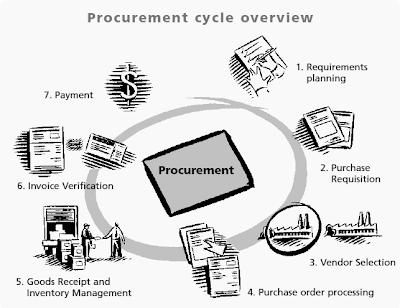

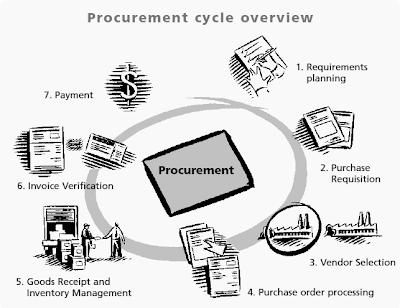

The procurement process commences with determining the requirement for materials/services. A purchase requisition should be raised for all goods/services that the organisation procures. Requisitions may be raised with reference to a contract or outline agreement which specifies a certain volume of a material that should be purchased from a particular vendor.

The system can also suggest an appropriate vendor for the material/service being procured via source determination (a vendor may be selected from a source list). The ability to approve/release purchase requisitions should be controlled via release procedures in the SAP system to ensure that only employees with the appropriate authority can authorise a purchasing transaction. Where appropriate, the system should enforce a tender evaluation process via ‘request for quotation’ functionality.

Purchase orders can then be created based on the requisitions and any related quotations. Purchase orders should not be created without reference to a purchase requisition. Any changes to the purchase requisition or purchase order should be subject to the appropriate approval procedures. Appropriate reports should be used to monitor long outstanding purchase orders. Master data relevant to the procurement cycle includes the vendor master and material master files.

Goods receipt

A goods receipt or the entry and acceptance of services should be performed for each purchase order. The goods receipt should be processed with reference to the corresponding purchase order. The entry and acceptance of services should be separated to ensure the appropriate authorization of services accepted for payment.

Invoice processing

Invoices are processed with reference to the appropriate purchase order and goods receipt transactions via the invoice verification transaction. Invoices that do not have a valid purchase order can be processed separately via the financial accounting accounts payable module. Any invoices that do not match the purchase order and goods receipt details within defined tolerances are automatically blocked for payment.

Invoices that do not relate to a valid purchase order in the system (eg utility payments) should be processed via the financial accounting accounts payable module. These invoices are not subject to the electronic approval enforced at the requisition stage and can be subject to authorisation controls at the invoice stage via payment release procedures used in conjunction with the ‘park and post’ functionality and SAP Workflow, to ensure that all invoices beyond a certain amount are authorised in accordance with approved delegation levels.

Payment processing

Payment runs should be performed on a regular basis and all payment reports, including payment exceptions (ie. blocked invoices), should be reviewed to ensure all payments are reasonable. Payments and the claiming of prompt payment discounts are driven by the payment terms, which should be entered in the vendor master record and should not be changed in the purchase order or invoice. Manual cheques should not be used, as the payment program can be run as frequently as required to process payments. This ensures an adequate level of control over payments and reduces the risk of unauthorized payments.

Previous Post is about SAP XI Introduction

Previous Post is about SAP XI Introduction

Interview Questions ALV Reports with sample code ABAP complete course

ABAP Dictionary SAP Scripts Script Controls Smart Forms

Work Flow Work Flow MM Work Flow SD Communication Interface

The system can also suggest an appropriate vendor for the material/service being procured via source determination (a vendor may be selected from a source list). The ability to approve/release purchase requisitions should be controlled via release procedures in the SAP system to ensure that only employees with the appropriate authority can authorise a purchasing transaction. Where appropriate, the system should enforce a tender evaluation process via ‘request for quotation’ functionality.

Purchase orders can then be created based on the requisitions and any related quotations. Purchase orders should not be created without reference to a purchase requisition. Any changes to the purchase requisition or purchase order should be subject to the appropriate approval procedures. Appropriate reports should be used to monitor long outstanding purchase orders. Master data relevant to the procurement cycle includes the vendor master and material master files.

Goods receipt

A goods receipt or the entry and acceptance of services should be performed for each purchase order. The goods receipt should be processed with reference to the corresponding purchase order. The entry and acceptance of services should be separated to ensure the appropriate authorization of services accepted for payment.

Invoice processing

Invoices are processed with reference to the appropriate purchase order and goods receipt transactions via the invoice verification transaction. Invoices that do not have a valid purchase order can be processed separately via the financial accounting accounts payable module. Any invoices that do not match the purchase order and goods receipt details within defined tolerances are automatically blocked for payment.

Invoices that do not relate to a valid purchase order in the system (eg utility payments) should be processed via the financial accounting accounts payable module. These invoices are not subject to the electronic approval enforced at the requisition stage and can be subject to authorisation controls at the invoice stage via payment release procedures used in conjunction with the ‘park and post’ functionality and SAP Workflow, to ensure that all invoices beyond a certain amount are authorised in accordance with approved delegation levels.

Payment processing

Payment runs should be performed on a regular basis and all payment reports, including payment exceptions (ie. blocked invoices), should be reviewed to ensure all payments are reasonable. Payments and the claiming of prompt payment discounts are driven by the payment terms, which should be entered in the vendor master record and should not be changed in the purchase order or invoice. Manual cheques should not be used, as the payment program can be run as frequently as required to process payments. This ensures an adequate level of control over payments and reduces the risk of unauthorized payments.

Previous Post is about SAP XI Introduction

Previous Post is about SAP XI IntroductionABAP TOPIC WISE COMPLETE COURSE

BDC OOPS ABAP ALE IDOC'S BADI BAPI Syntax CheckInterview Questions ALV Reports with sample code ABAP complete course

ABAP Dictionary SAP Scripts Script Controls Smart Forms

Work Flow Work Flow MM Work Flow SD Communication Interface

No comments:

Post a Comment